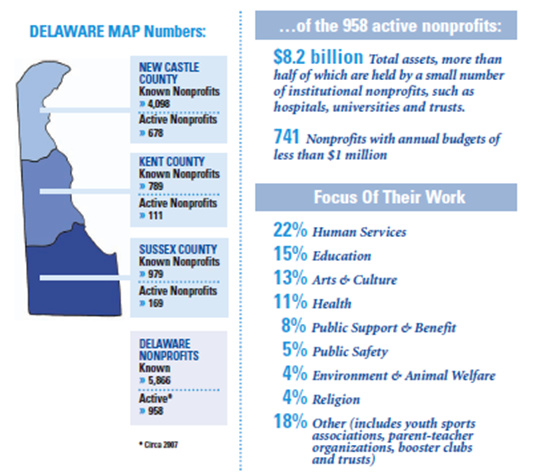

As the year’s end quickly approaches, don’t forget to take advantage of your last minute giving and capture those 2012 tax breaks. According to the Delaware Association for NonProfit Agencies, there are more than 678 active non-profit organizations in New Castle County. So how do you choose? Read on – NorthDelaWHEREHappening.com is here to help.

Did You Know?

DELAWARE – National research suggests that paid employees of nonprofit organizations represent 7.2% of the U.S. workforce. When volunteer workers are added, the nonprofit sector comprises 10.5% of the total workforce. In Delaware, the nonprofit workforce –43,365–is significantly larger than that of many Delaware industries: the 2,143 workers in the utilities industry, the 14,845 employed in wholesale trade, and the 27,256 employed in construction. Learn more about Delaware Non-Profits and for a list of all Delaware Non-Profit Agencies in the Delaware Report on Non-Profits 2012 and by visiting www.delawarenonprofit.org.

U.S. – In 2011, Americans donated $217.79 billion, up 3.9 percent from 2010, according to an annual report on philanthropy from the Giving USA Foundation. That’s a whole lot of giving! And the average person makes 24% of his or her annual donations between Thanksgiving and New Year’s Eve, according to research from the Center on Philanthropy.

Top 7 National Charities

Here’s a look at the Top Seven Charities that made the top 100 list compiled by the Chronicle of Philanthropy for 2012:

- United Way

- Fidelity Charity

- Salvation Army

- Catholic Charities U.S.A.

- Task Force for Global Health

- Feeding America

- American National Red Cross

Before You Open Your Checkbook…

Ensure the Charity is Valid…From the office of Attorney General, Beau Biden

Check out the charity websites and with organizations that evaluate charities:

- BBB Wise Giving Alliance www.give.org

- American Institute of Philanthropy www.charitywatch.org

For many organizations financial information may be found online at:

IRS Offers Tips for Year-End Giving

Guidelines for Monetary Donations

To deduct any charitable donation of money, regardless of amount, a taxpayer must have a bank record or a written communication from the charity showing the name of the charity and the date and amount of the contribution. Bank records include canceled checks, bank or credit union statements, and credit card statements. Bank or credit union statements should show the name of the charity, the date, and the amount paid. Credit card statements should show the name of the charity, the date, and the transaction posting date. Donations of money include those made in cash or by check, electronic funds transfer, credit card and payroll deduction. For payroll deductions, the taxpayer should retain a pay stub, a Form W-2 wage statement or other document furnished by the employer showing the total amount withheld for charity, along with the pledge card showing the name of the charity. These requirements for the deduction of monetary donations do not change the long-standing requirement that a taxpayer obtain an acknowledgment from a charity for each deductible donation (either money or property) of $250 or more. However, one statement containing all of the required information may meet both requirements.

IRS.gov has Additional information on charitable giving including:

- Charities & Non-Profits

- Publication 526, Charitable Contributions

- source: http://www.irs.gov/uac/Newsroom/IRS-Offers-Tips-for-Year-End-Giving-2012

Leave A Comment